It shouldn’t really matter that Loki will hit Disney+ on Wednesdays instead of Fridays, except that it speaks to Disney+ hitting the stride that executives promised back in December.

Every other Disney+ series or film lands on the streaming platform on Fridays. This isn’t a random date. It’s the day that people might want to unwind with a new episode of The Falcon and the Winter Soldier or The Mandalorian, a date that people might feel less guilty about showing up to work a little late to fit into their morning routine, and it leads directly into the weekend.

Disney knows it’s going to own at least an hour of your time between Friday and Monday. What was once a graveyard date for linear television (there’s a reason that Star Trek’s third season air date led to the phenomenon known as the “Friday Night Death Slot”) is an opportunity for streamers. Disney doesn’t have to sell ads on the spot and worry about viewership. As long as there’s new content available, and it’s something subscribers are anticipating, Friday is a great day.

(Plus by releasing on Friday, Disney can own streaming leading into the weekend, and then start tweeting or posting on social media about moments in the episode on Monday, ensuring that conversation continues every week. If this works, Disney drives stragglers to the new episode or show between Monday and Thursday, too.)

Knowing that, why would Disney give up its perfect day to release Loki on Wednesday, competing with other appointment TV on regular television and smack dab in the middle of people’s weeks? The simplest answer in this scenario is probably the correct one — Disney+ finally has enough content to space out its biggest titles.

Or, more simply, Disney+ now has enough content to give subscribers a reason to open the app multiple times a week. Add in a bolstering library, and new series down the pipeline, it’s clear Disney is working on boosting daily engagement, not just worrying about adding enough new subscribers every single quarter.

Usage makes the world go round

Key elements to running, growing, and monetizing a streaming service effectively boil down into three distinct categories:

What leads to people signing up (growth)

What people are spending their time watching while on the platform (usage)

What is preventing people from canceling their subscription and keeping attention (retention)

Disney has the first and third down pat. Each new, big Marvel and Star Wars show, or new movie that hits Disney+, likely leads to an increase in subscribers. Those who may not have been interested in The Mandalorian could have signed up for WandaVision. Those who canceled their subscriptions after Falcon and the Winter Soldier and ahead of The Bad Batch may sign up again just in time for Loki. Or, in the pivotal case of Hamilton, those who have no interest in a Disney-only streaming service finally have a reason to give Bob Chapek and co. seven dollars a month.

That’s growth. The third is what keeps people from canceling. If you’re a Marvel, Star Wars, Pixar, National Geographic or, of course, Disney fan, you’re not going anywhere. If you’re part of a family with young kids, there’s arguably no better app than Disney+. It has their favorite movies, but it’s also safe. While older kids might gravitate toward YouTube and Netflix, where the risk of kids seeing something they shouldn’t (either via recommendations or an adult title getting through), Disney+ is guaranteed safety because Disney’s brand is 100% child and family friendly.

So — Disney+ clearly has no problem growing (1), and third party reports suggest that Disney+’s retention rate is pretty low (3). This means the biggest aspect of a streaming business to work on is engagement (2). More consistent engagement can be achieved through a couple of different methods, two of which are not difficult for Disney with its arsenal: high profile, daily appointment content and building a desired library.

Daily content and having a library is easy; making that daily content appointment worthy (meaning people feel like they have to open the app at least once) and making that library desirable (meaning people think of it as their go-to when looking for something to settle into before bed) is difficult.

Consistency is key

Let’s dig in a little. My steadfast belief is that when you’re creating within certain franchises, the overlap for subscribers is massive. This can potentially limit growth. For example, Marvel fans who signed up for Disney+ originally to rewatch Cinematic Universe installments or for WandaVision already have Disney+. Disney doesn’t have to market the streaming service to them.

Take HBO Max. WarnerMedia executives touted Wonder Woman 1984 as driving sizable signups when it was released in December. Although WarnerMedia never announced how many subscribers Godzilla vs Kong or Justice League drove, executives did tout record engagement and viewing over the first weekend. Therefore, we can assume that Godzilla vs Kong and Justice League didn’t drive record signups, but the overlap from those on the platform who already signed up was present.

Both HBO Max and Disney+ are still adding subscribers with each new installment, but The Mandalorian will drive more subscribers than The Bad Batch, and WandaVision likely drove more subscribers than Falcon and Winter Soldier. It’s also likely, however, that Falcon and Winter Soldier saw more overall engagement because of higher subscriber numbers. And it’s also likely that people who want to get in on Bad Batch will spend more of their time watching Clone Wars to prepare for the show. It’s an ouroboros methodology and it works.

For non-families, Disney+ subscribers may open the app once a week — on Fridays, when new episodes drop. Maybe they open it twice a week when they want to watch a specific movie after work or on the weekend. Unlike Netflix, Paramount+, HBO Max, Peacock, and Hulu, which offer some of the widest breadth of general entertainment programming for both adults and kids, Disney+ doesn’t actually have much.

This is both a subjective opinion, but also something people on Twitter @ me about all the time. Look, there’s a reason that Disney turned Star into an extra tab within Disney+ in Europe. The Simpsons is the only snackable programming Disney+ has — that’s not enough when competing with other streamers who have hours of familiar content (wind down and sleep shows) plus new things.

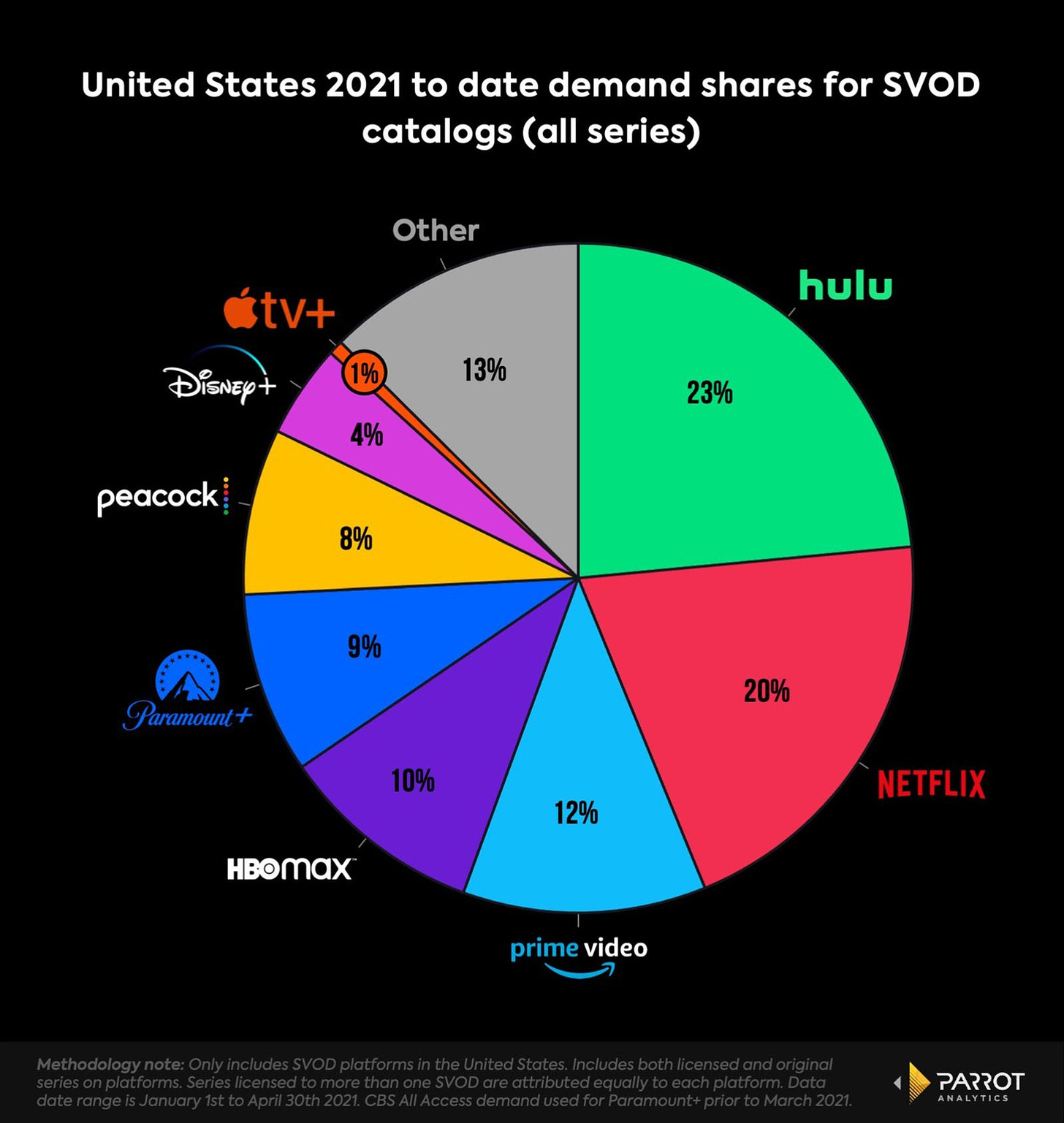

None of this implies that Disney+ is struggling by any means. It’s not. But whereas competitors might give subscribers more reasons to open the app daily, Disney+ is still looking for its constant. Disney+’s catalog makes up 4% of catalog demand in the US, according to Parrot Analytics, behind all of the other big streamers. Internal restrictions (nothing above PG-13 can be on the app, nothing outside of Disney’s core brands) means the catalogue can only grow so large each month.

We’re getting there, though. Disney moving Loki to Wednesdays is in part because The Bad Batch is running on Fridays through mid-August. In-between that time, Disney is bringing back High School Musical: The Musical: The Series (on Fridays) and see big movie debuts, including Cruella and Black Widow in May and July respectively. Disney+ has appointment viewing spots for Friday and into the weekend. But Disney wants to increase consistency in engagement throughout the week.

Disney is in a rare position where over the next 10 months the company will have a high profile show or movie every single day, every single week. A new movie, overlapping Marvel shows, a Star Wars series, a Pixar series, and other potentially big live-action projects. These series overlap and create a consistent flow of appointment television that all bleed into one another. For all the conversation about “franchise fatigue,” statistically that’s not present in actual consumer behavior.

There’s a reason that consistency is key to any business model, but with streaming, if subscribers are consistently opening and using a platform, this leads to less churn and Disney feels better about raising prices incrementally. This helps with overall ARPU in important regions. Or, to put it simply, Wall Street is happy, Disney executives are happy, and consumers are fine with the increase because the value is apparent.

Muscle memory

As I’ve written before, Netflix’s biggest strength is that it’s muscle memory. Opening the app multiple days and nights throughout the week isn’t a thought, it’s just something people do. It’s built into their OTT remotes, it’s the first app that appears when they open their television set, and with new series and films, alongside a remarkably sizable library, Netflix becomes daily. Netflix maintains 34% of streaming minutes in the US, ahead of YouTube (20%), Hulu (11%), Disney+ (4%), and others (23%), according to Business of Apps.

Part of the reason that Netflix is muscle memory is because Netflix got in first. This means Netflix had the biggest licensed library. Paired with Ted Sarandos and co pouring billions of dollars into original content, much of which showed what a streaming-first platform could achieve, Netflix had a massive advantage over competitors. It became the app people cord cutters automatically sought out.

What Netflix has trouble with is Disney’s bread and butter — building and maintaining franchises that people love. And that is key. Disney’s strength as an entertainment company is being able to produce stories that people genuinely love, both on and off the screen, that move from medium to medium as technology changes. As Disney expands its biggest franchises, and as long as fan sentiment remains mostly positive, Disney+ goes from being a once-a-week option to something more consumers open nearly every single day.

We tend to only think of the benefits that streaming brings to traditionally linear companies, but there are advantages in linear that companies can bring to streaming. Having weekly releases, and spreading out those shows throughout the course of a week makes Disney+ feel like a must-have and must-use; ensuring customers are also aware of the always-available-library and enhancing discovery abilities to surface a viewer’s next big watch reminds subscribers of the advantages streaming provides.

Disney is moving Loki to Disney+ because the promise of what Disney+ could be — having something exciting every almost every single day of nearly every single week — is beginning to play out.

Last week’s IGN column — Apple vs Epic became the internet’s trial

I wrote last week about how YouTube and Twitch were the perfect places to watch Epic and Apple’s ongoing lawsuit. Below is an excerpt from said column. Read the rest at IGN. Tomorrow’s is all about Nickelodeon!

-------------

We knew that Epic vs Apple, the ongoing battle for rights to in-app purchases, would be revealing. But we didn't expect it to be this entertaining.

Part of it has to do with where the trial is playing out. From speedy chatbars on YouTube to live commentary on Twitch, and all the tweets along the way, Epic vs Apple became the internet’s trial. The gaming industry is particularly protective, so hearing executives like Tim Sweeney air dirty laundry about the behind-the-scenes conversations and deals with executives at Microsoft, Sony, and Apple feels even juicier.

Epic vs Apple isn’t just a case with revealing testimonies and spilled secrets, though. Following Epic vs Apple on Twitch and YouTube works particularly well because it’s a trial that feels like it belongs to the internet. It may seem like this trial comes down to one multi-million dollar corporation wanting more of a cut from the other multi-million dollar corporation. But, removing that surface level fight, it also leaves players with iPhones without access to a beloved game (whether you agree that it should be beloved or not).

At the heart of this lawsuit, one that pits Goliath against Goliath, is a growing malaise, a surging discontent, from Davids around the world: players.

On the internet, a platform founded on the very ideal that everyone should have access to information and equal opportunity, thousands of people are intently watching a trial about walled gardens operated by some of the wealthiest companies in the world. The trial is less about whether Apple or Epic is in the wrong — believe me, there are opinions in every chat — and more about closed off ecosystems that remove opportunity for the everyday person.

Where better to congregate with other players than on Twitch and YouTube?

Isn't usage more of a sub-category of retention? Everything you described about the importance of usage sounds like basically the same thing as preventing cancellations, so I don't see how usage and retention are considered different things in terms of profit generation. If you have growth and retention, isn't usage superfluous?