Movie Equations: Soul's win in China

Introducing a second weekly newsletter, dedicated to the math of movies

[Hello! I know what you’re thinking: what the hell is this and what’s it doing in my inbox? Good question! I’m so excited to introduce Movie Equations, a complimentary weekly newsletter dedicated to breaking down the box office in a streaming-focused world. This one won’t be Disney exclusive, either. The idea is simple — we’re going to hear more conversations about why studios decide to release a film in theaters, simultaneously on streamers and in theaters, or exclusively on streamers. By studying trends, looking for anomalies, and tracking it all week-by-week, we’ll get a better understanding of what moves to make, changes to take, and which ideas are fully baked.]

With that said, it’s time to talk about Soul.

Soul, Disney Pixar’s latest film that explores life’s true purpose, death, and the afterlife, could become Pixar’s second most popular film of all time in China. Last week, Disney reported that the film has amassed more than $43 million, putting in third place behind The Incredibles 2 ($51.5 million) and Coco ($189.2 million). Compared to other Pixar films, which failed to find an audience in China but performed exceptionally well domestically, it’s an impressive feat for the film.

Or, to put it another way, China has accounted for 64% of all international box office revenue. In this case, that’s the entire box office.

There are questions that need to be answered, the first being why did Soul perform when other Pixar films haven’t? The answer is mostly obvious — Chinese movie attendance is back to nearly normal levels compared to the rest of the world where surges in COVID-19 cases have kept people home and theaters closed. Soul is also one of the few new movies that’s actually available for people to go and see. Eliminate competition, and it’s easier to dominate the box office. By circumstance, considering China was the first company to achieve full box office recovery, according to Gower Street, an analytics firm based in the U.K.,Soul had an audience who were willing and able to head to theaters.

Still, that’s not true for other films. Wonder Woman 1984 has only grossed $25 million in China — a far cry from the $36.2 million opening weekend Wonder Woman saw in 2017. The $25 million figure, which comes after four weeks of playing in theaters, also means it’s increasingly unlikely that Wonder Woman 1984 will come close to capturing Wonder Woman’s original $90.5 million run in China. While Wonder Woman 1984 is under-performing, Soul is over-performing. Unlike competition between the films in the US — Soul is not available in theaters as it’s a Disney+ exclusive while Wonder Woman 1984 was released simultaneously on HBO Max and in theaters in the United States — the only way to watch either film in China is in theaters.

Why are focusing so much on China instead of other international territories? Wonder Woman 1984 and Soul are both streaming in other countries around the world. True! But there are a few primary reasons I want to use this secondary newsletter to focus on certain box office markets (primarily China) and, simultaneously, streaming.

China is on path to become the dominant box office market, and already beat the US in 2020 for biggest box office revenue.

Most major streamers coming out of the United States are not in China, and companies face ongoing issues getting those streamers into China.

As more studios look at shortened exclusivity windows in theaters, simultaneous releases on streaming platforms, or streaming exclusives, box office performance in other territories becomes increasingly crucial.

The industry is trying to figure out how to use new distribution tools and shortened windows to determine what should receive a longer, shorter, or traditional theatrical release. Finding patterns for what works in one of the most important markets — and whether that can help bolster box office revenue while growing subscribers domestically and in other regions on streaming services where recurring revenue is the primary goal — is crucial.

So, looking back at the original question: why did Soul perform well when Wonder Woman 1984 didn’t? Superhero films typically over-perform in China, while Pixar has struggled to find consistent success with its films in the country. Batman v Superman: Dawn of Justice did $95.8 million in China, or about 28% of Batman v Superman’s domestic take. Justice League amassed $106.1 million in China — about 47% of the film’s entire domestic box office revenue. And Wonder Woman’s original $90.5 million box office haul in China accounted for about 22 percent of the domestic haul. Not bad.

In comparison, Pixar’s movies typically don’t come close to those margins in China. Inside Out was one of Pixar’s biggest non-sequel successes internationally and domestically, but didn’t travel as well in China. Big hitters like Finding Dory, Incredibles 2, and Toy Story 4 found an audience in China, but compared to their domestic releases, didn’t over-perform the way that Coco and Soul did. While animated films from international studios (like Disney Pixar) have historically performed better than domestic animated films — though that will likely change as the Chinese film industry continues to mature — they still don’t compare to live-action imports, especially superhero films and general action blockbusters.

Some of the answers can be found in Coco’s success. When Coco debuted in November 2017, it amassed $17.8 million in its opening weekend. By the second weekend, however, ticket sales soared by nearly 150%, and by the third weekend, Coco had surpassed $100 million in China. By the fourth weekend, Coco’s reception in China outpaced the United States, amassing more than $154 million in China compared to the US’ $150 million.

What changed in-between the first and second week for Coco to soar that much? Word of mouth, good reviews on Chinese sites like Douban Movie, and a cultural connection to the film helped spur it into Pixar’s most successful title ever in China, and Disney’s second most successful animated film behind Zootopia ($236.1 million). The Qingming Festival is one of the most celebrated in China, and focuses on cherishing family members, both alive and those who have passed. Coco’s message, about that exact thing, likely resonated well with Chinese filmgoers, Stanley Rosen, a political science professor at USC’s US-China Institute, told The Wrap in 2017.

The same thing happened with Soul. The first weekend it was released, Soul generated $5.5 million, double what Onward made in its opening weekend (at the height of the pandemic). By the second week, however, ticket sales jumped 149%, bringing in $13.7 million. On sites like Douban and Maoyan, the film received scores of 8.9/10 and 9.6/10 respectively, making it the highest rated film in China in December 2020. Those scores also make it one of the highest rated Disney and Pixar films in China of all-time. With theaters being mostly back to normal in China, and audiences ready to watch a highly rated movie with their family, Soul was the perfect option.

For Disney, having Coco and Soul perform exceptionally well in China — especially considering they’re new IP — is good news for global distribution plans. Especially as Disney continues to build out its Shanghai Disney resort, which opened in 2016, incorporating more Pixar characters into the park, which saw 11.8 million guests visit 2018 and on average generates more than $1 billion in revenue. Disney will try and continue to establish Pixar as a dominant force in China, using its parks and well received movies like Soul and Coco to do so.

Going forward, many companies will have two priorities: generating decent ROI for theatrical releases and boosting streaming subscriptions while retaining current customers. The easiest option to meet the first priority is releasing blockbusters a few times a year that are likely to generate revenue beyond breaking even. For example, Marvel and Star Wars films are pretty much guaranteed wins; it’s the size of the win that fluctuates. The outlier here being Solo, which vastly underperformed and lost more than $50 million. Meeting the second priority means figuring out what’s a better streaming exclusive title, or what might work better as a simultaneous release. Box office wins are no longer the only thing a film needs to accomplish for companies like Disney and WarnerMedia, even if they’re still vitally important.

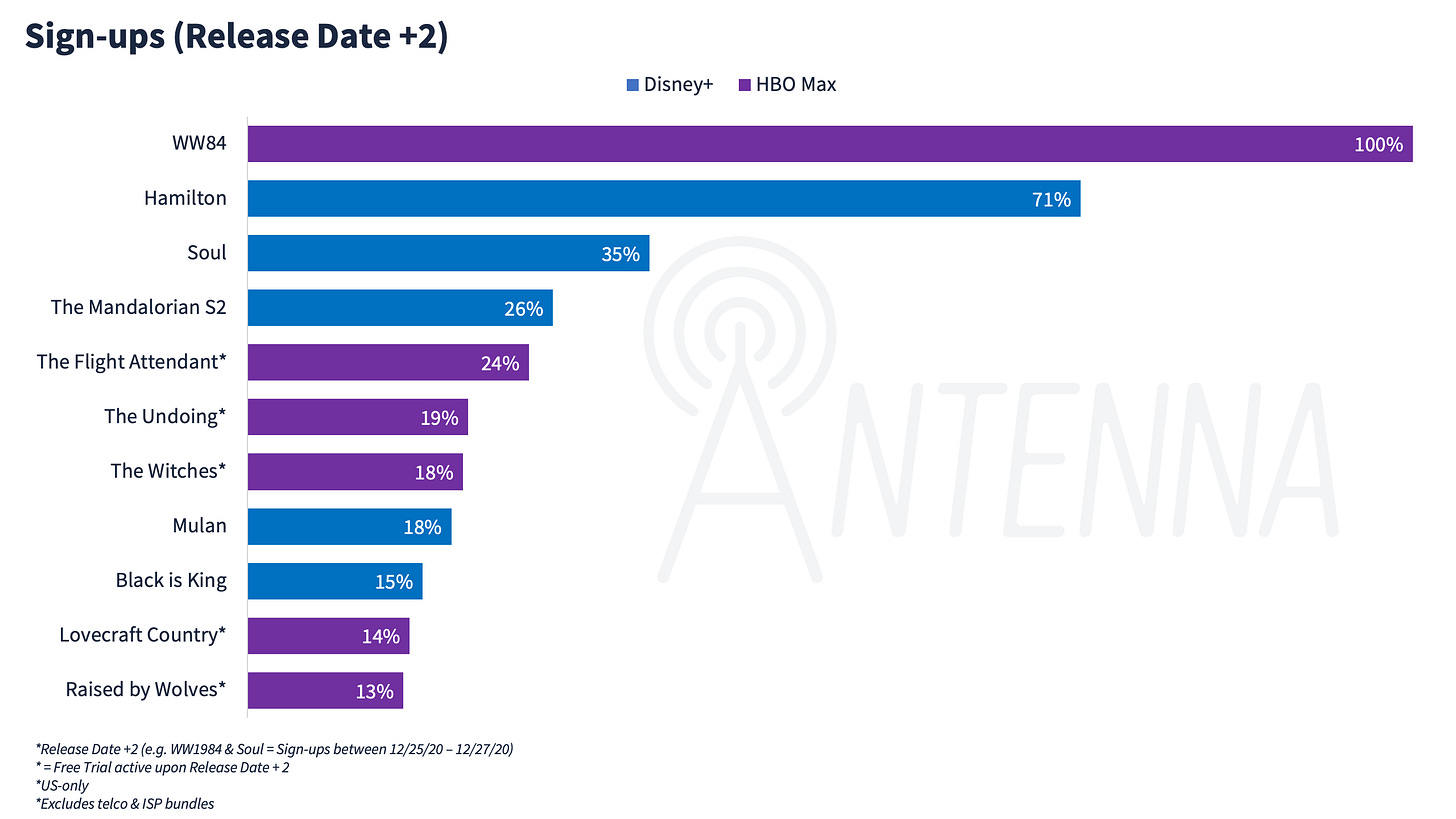

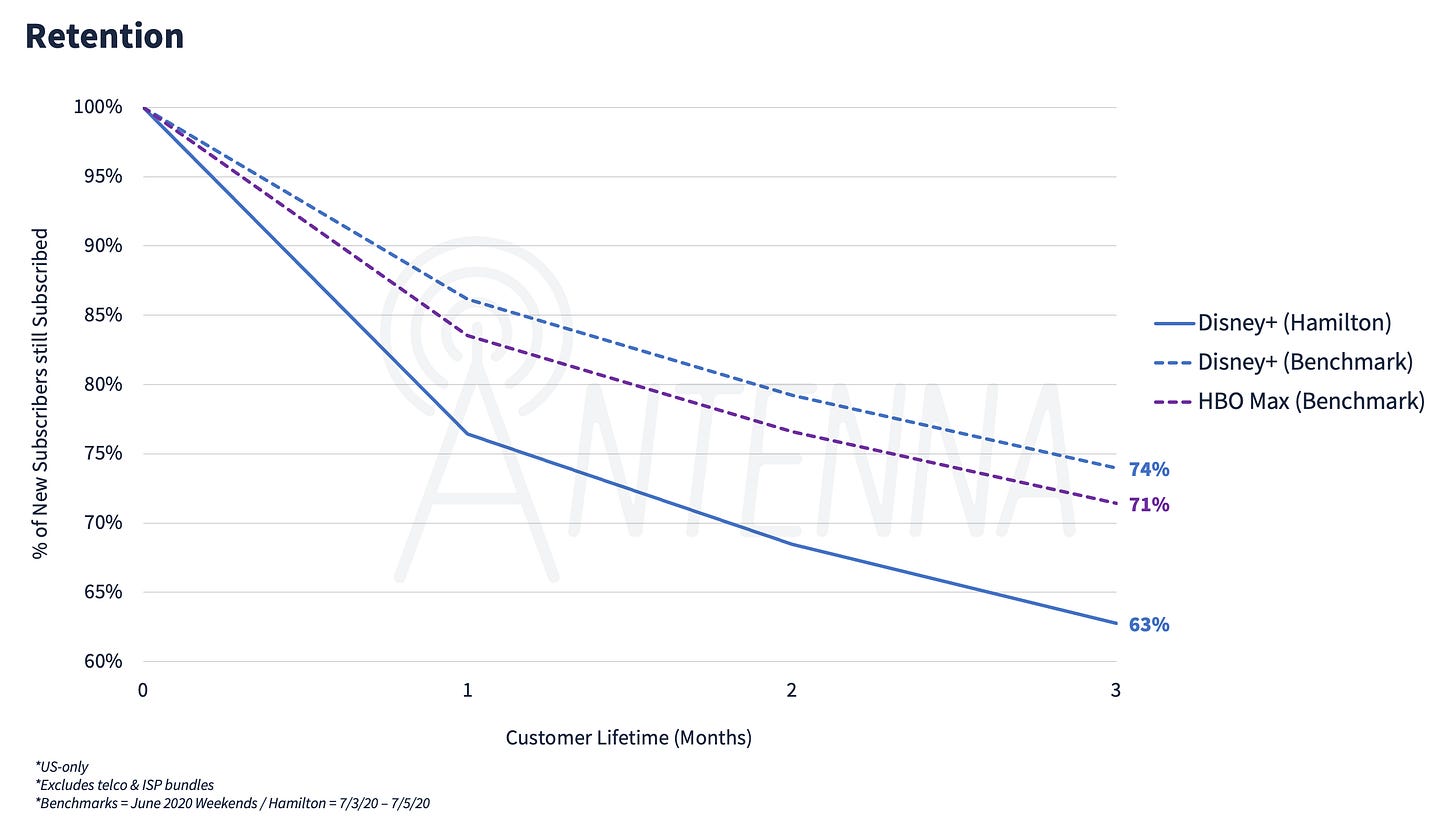

Consider that while Soul has generated nearly $50 million in China despite little marketing, the film has also seemingly helped add Disney+ subscribers. Data from Antenna research firm shows a 35% bump in signups for the first two days of Soul’s release. More importantly, more subscribers signed up for the annual subscription when Soul came out compared to Hamilton, which saw more monthly subscribers. Since Disney removed the seven-day free trial prior to Hamilton’s premiere on Disney+, we can assume that many of the people who signed up for Disney+ to watch Hamilton may have done so with the inclination to cancel after the one-month period. Further data from Antenna, which shows that Disney+ only retained 63% of subscribers who signed up around Hamilton’s release compared to retaining 74% of benchmark subscribers.

Would Disney have liked to release Soul in theaters? Of course. The film was originally delayed when the pandemic was first coursing through the country because Disney executives hoped to release it in theaters when things went back to normal. Except normality never came. Disney was instead able to add a number of Disney+ subscribers and, ideally, turn that release into a bout of recurring revenue while saving some of the marketing costs traditionally associated with theatrical releases. Going forward, an ideal solution might be a simultaneous release, where Disney can have movies in theaters and on Disney+, giving people the option. Or, taking advantage of reduced windows to have a Pixar movie like Soul play for three weeks (where a film typically makes the majority of its revenue) before moving it to Disney+ to try and gain additional subscribers.

Sony Pictures CEO Tony Vinciquerra recently told CNBC that international box office revenue accounts for 60% of a film’s entire revenue. China is on track to become the biggest box office in the world pretty soon. It’s also a country where it’ll remain increasingly difficult for streamers to enter without partnering with a Chinese conglomerate. But, if that can become the dominant box office territory, studios can reconfigure their strategy to find ways to ensure a proper return on investment while also prioritizing streaming in territories that are flocking to subscription services.

While nothing will ever replace what a full scale theatrical release can do for a studio, realistically, there are better ways of releasing movies than what we’ve done for the past 60 years. Soul, and Coco before it, just proved that it doesn’t have to be superhero movies and sequels to see that success happen.