Depending on where you live, a “new” Disney streaming platform is launching today — Star.

Except, it’s not really new. It’s not designed to be. Star, an international addition to Disney+ that will launch in Europe and some other markets, is designed around the old. Scrolling through a sea of titles like Deadpool 2, Modern Family, How I Met Your Mother, 24, and Lost should feel familiar. Like finding the best 2007 hits playlist on Spotify and listening to it for the night, Star’s primary goal is ensuring people never stop streaming Disney+. Even with new series and Star-branded originals, the objective isn’t to flood subscribers with new series they might turn into after WandaVision or Stargirl or The Mandalorian; the idea is to get them to throw on an old episode of How I Met Your Mother or rewatch American Horror Story.

In the United States, part of the solution is the Disney bundle. Executives seemingly hope that people will flip back and forth between Disney+, Hulu, and ESPN+ (from time to time). Whether or not that’s actually happening is unclear. Hulu is building its subscriber base alongside Disney+, but without data it’s impossible to say for certain if those bundle subscribers are actively seeking out Hulu content. Data from research firm Antenna does indicate that Hulu subscribers who cancel come back to the platform within six months and 60% of those returning subscribers stay for longer than six months. The same is true for Netflix.

What Netflix has that Disney does not, however, beyond an additional 110 million subscribers or so, is a library of TV shows and films that keep people watching even after they marathon a new original series or film. For example, this past weeked I made my way through Crime Scene: The Vanishing at Cecil Hotel and I Care A Lot before winding up watching what I watch every night: New Girl and Arrested Development.

I don’t have kids, and I’m not always in the mood to watch a Disney Channel original, a Pixar, or a Marvel movie. Netflix doesn’t have to try and serve me something to keep me watching (although the streaming platform absolutely does this via its recommendation algorithm). There’s something I’m going to throw on because Netflix had more than 47,000 episodes of television and 4,500 films in 2019. Disney+ didn’t have a third of that, and of the available offerings, I’m not interested in a decent amount.

There are three key areas to keeping a subscriber happy, willing to put up with any incremental price hike and stop a wandering eye from every new streamer:

Culturally catching content

Snack content

Consistency or freshness, but ideally both

“Are you watching—”

The first is where WandaVision or The Mandalorian fit into Disney’s equation. Entertainment news cycles every single Friday and long into the weekend are driven by whatever happened on the most recent episode of a show. People look up explainers to better understand what they’ve seen, start creating spoiler-lite and spoiler-heavy memes on sites like Twitter or apps like TikTok, and may rewatch it a second time to see things they missed upon first viewing.

Culturally catching content is a mouthful of a phrase, but it just means that people want to watch it because other people are watching it, and they want to be included. It’s Game of Thrones or the NBA championship games, or Stranger Things.

Wonder Woman 1984, Hamilton, and Soul drove the biggest number of subscribers to HBO Max and Disney+ respectively, according to data from Antenna. That’s impressive, but this is the more key data point: “Nearly a quarter of Subscribers who joined Disney+ on Hamilton's opening weekend cancelled within one month. Three months later, 59% of Hamilton Subscribers remained Subscribed to the service.”

Once customers signed up for Disney+ to watch Hamilton — a different subsect of customers who signed up for the streaming platform in November 2019, who are likely Disney’s core audience (families, Star Wars/Marvel fans, general Disney buffs) — there was nothing to keep them. While 70% of HBO Max subscribers and 77% of Netflix subscribers who joined in June remained subscribed 90 days later, it was 69% for Disney+.

Ultimately, June through September 2020 didn’t have much beyond Hamilton. Today, Disney+ will have a new Marvel Studios show every week, on top of movies like Raya and the Last Dragon and new Star Wars or Pixar projects. It’s a lot less empty, and ultimately, Disney+ still has one of the lowest churn rates of all the streaming services, coming in at just under 5% with an industry average of roughly 6.2%. For anyone with kids, Disney+ is a no brainer. For Marvel and Star Wars fans, same thing. For everyone else, the question is what do I really get for $7 (soon to be $8) a month. The answer is in the old adage: acquisition is an originals game, but retention is a library game.

It’s not the streaming wars so much as it is the churn wars. Most services can convince a number of people to sign up — how do you keep them? Give them what they’re not looking for, but need.

Play the hits

Snack content. It’s how I refer to comfort food TV like Modern Family or New Girl. It’s the thing you always have in the house because when you’re trying to relax, it does the trick. This is where streamers like Netflix, HBO Max, Peacock, and Hulu work well. In the United States, that’s beneficial to Disney, who can try and convince subscribers to sign up for the Disney Streaming bundle. A big part of Hulu’s offering is its library, and part of that is because of ongoing licensing deals with companies like NBCUniversal and ViacomCBS.

Internationally, things are different. Everything on Disney+ is 100% owned by Disney. That means its TV shows and films from ABC, FX, Freeform, Searchlight, and 20th Century Studios. Disney doesn’t have to pay anyone licensing fees, and doesn’t have to spend money on launching an entirely new platform. Instead, Star is built into Disney+’s existing technology but offers totally different viewing options than ever before. Two streaming services for the price of one, basically — all Disney is asking is a $1 dollar price increase. That’s not bad for a Hulu-lite replacement for parents who want to watch something R-rated when the kids have gone to bed or just want to binge Prison Break again.

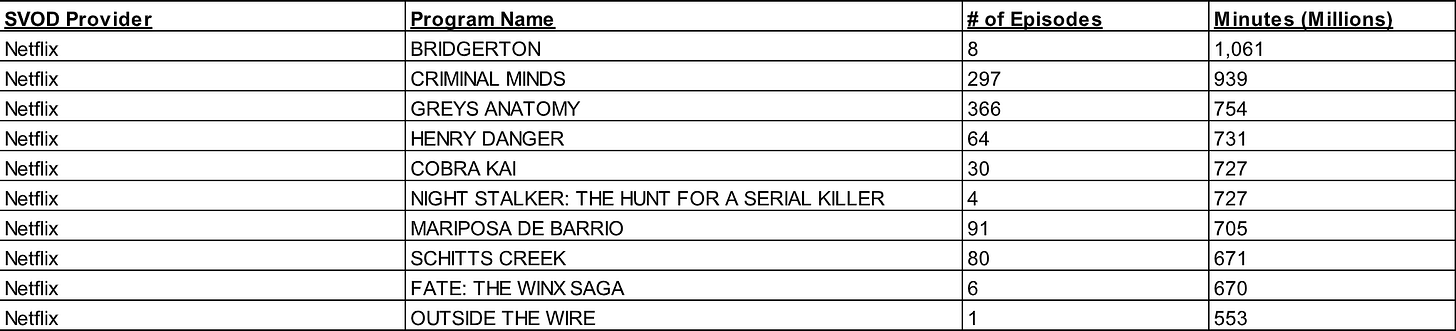

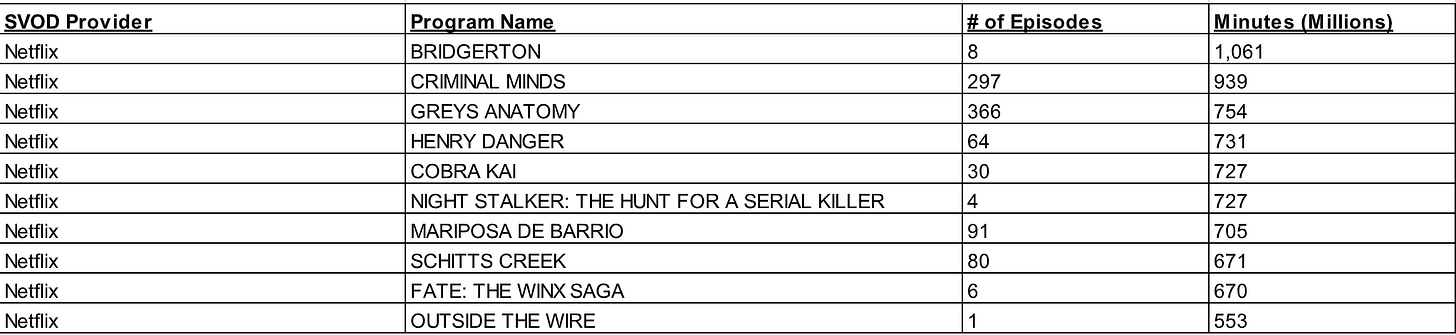

These shows are integral to maintaining viewers. If we take weekly Nielsen ratings (adding in the obligatory disclaimer that Nielsen ratings are far from perfect), examine the top original titles compared to films and acquired or licensed series. Four of the top five most watched SVOD titles last week were acquired series; the one original was Bridgerton, which has turned into a massive success for Netflix (as far as we can tell without any actual data from the streamer). Timer spent watching acquired series also outpaced original series, with the bottom three acquired series (New Girl, NCIS, and L.A’s Finest) seeing 100 million+ more minutes watched. Even if Nielsen doesn’t track international viewing, behavior patterns apply across the board. That’s what we’re studying.

Now, part of this is that licensed series often fall into the “would be syndicated” bracket. This means there are usually more than 100 episodes, and people can marathon for days on end. That’s partially, I assume, why Grey’s Anatomy and Criminal Minds are consistently in the top 5 with 317 and 324 episodes respectively. WandaVision only had three episodes by the time this data came out and Bridgerton had nine. But, more importantly, despite WandaVision, Soul, Moana, Frozen II, and Beauty and the Beast all making their respective top 10 lists (top original series, and top films), none broke into the overall top 10 SVOD titles. Those all belonged to Netflix — 60% of that list belonged to licensed series, 83% of which I’d describe as comfort TV.

Analyzing that is simple: people are coming to watch new shows, but they’re not spending the majority of their time rewatching the same thing, nor are droves of people all watching Beauty and the Beast again. What people are returning to after they’ve gotten their fill of new content is comedies, kids programming, and procedurals that they can throw on in the background, relax, or fall asleep to. Nielsen data from weeks prior mostly presents the same case.

So, enter Star. By adding it as a tab on Disney+, and not forcing people to sign up for another streaming service, Disney executives are hoping people just switch over and continue streaming. From a data point, that’s likely the case. Disney+ and Star will still have to compete with local streamers in each country and the two global giants, Netflix and Amazon Prime Video, but having comfort content for subscribers to snack on for the rest of the night.

The key to being a winner in the streaming races is being everything for someone as often as possible, and having something for everyone 100% of the time. Be non-negotiable. Disney+ is already non-negotiable in a number of ways, but its biggest weakness is not having a wealth of comfort TV for anyone over the age of 16. Hulu still requires people opening another app; Star makes it so no one has to leave.

If the key to keeping people happy is to provide them with a) culturally catching content, b) give them something to come down with that’s familiar and relaxing after the fact, and ensure the first one is consistent while the second one is constant. They sound familiar, but they’re different. People want the same experience as WandaVision or Game of Thrones with their friends and the greater internet at large, but when they’re lying in bed or sitting on the couch, they want to know their favorite comfort titles are constantly there.

Star has the potential to offer the second important part of this equation. And it leads into the far more important question that everyone I know has thought about — what the fuck is going on with Hulu and what is Hulu’s future? Is the idea to roll Hulu into Disney+ by the time Comcast’s portion is paid off in 2024? Does it become Disney owned titles only, too? Or does Disney keep Hulu and Disney+ totally separate in the US, giving Disney the ability to make ad revenue via the former and focus entirely on growing the latter’s SVOD business?

I expect we’ll learn more about all those plans in the next little while, but for now, Star is here, and I think it’s the most exciting Disney product innovation to happen in a while. It’s obvious — so, so obvious — with little heavy lifting. But the growth and retention potential is astronomical.

good insights here, thx

I think Disney branding is very important in the U.S. If Hulu becomes a tile on Disney+, I don't know how Disney will effectively market adult content for the service. "Come see Handmaid's Tale, only on Hulu, which is actually on Disney+". Ultimately you're selling mature content on a family service, which is a tricky tightrope to walk.